Authentic China Instant Noodles Quick, Delicious Meals Ready!

- The Rising Tide of China's Noodle Market

- Engineering Excellence in Noodle Production

- Market Leaders Head-to-Head Comparison

- Tailored Manufacturing Solutions

- Real-World Implementation Scenarios

- Nutritional Evolution in Product Lines

- The Global Trajectory for China Instant Noodles

(china instant noodles)

Understanding the China Instant Noodles Phenomenon

China's instant noodle sector dominates global production, manufacturing over 40% of worldwide output annually. Current market valuation stands at $15.2 billion with projected 5.8% CAGR growth through 2027. Urbanization and changing lifestyles fuel demand, particularly among China's 300 million mobile-first consumers who prioritize convenience. Regional preferences create distinct segments - northern provinces favor wheat-based varieties while southern consumers show stronger preference for rice noodles.

Technological Innovations Driving Quality

Leading Chinese manufacturers employ advanced flour maturation systems allowing precise gluten development control. Modern factories implement fully-automated steaming and drying tunnels achieving moisture consistency within ±0.5% tolerance. Cutting-edge oil control technology reduces fat content by 30% compared to traditional methods while preserving flavor integrity. Novel packaging solutions incorporate oxygen scavengers extending shelf-life to 12 months without preservatives, alongside microwave-safe containers that maintain structural integrity up to 120°C.

Major Players Comparative Analysis

| Manufacturer | Market Share | Production Capacity | Export Ratio | R&D Investment |

|---|---|---|---|---|

| Tingyi Holding | 43.7% | 18 billion packs/year | 28% | $86 million |

| Uni-President | 20.1% | 9.2 billion packs/year | 35% | $48 million |

| Baixiang Food | 9.4% | 4.3 billion packs/year | 41% | $22 million |

| Jinmailang | 7.9% | 3.8 billion packs/year | 18% | $17 million |

Customized Production Capabilities

Specialized factories offer modular production lines capable of switching between fried, non-fried, and cold noodle formats within 72 hours. Flavor customization extends beyond standard profiles to incorporate regional Chinese spices, fermented specialties, and international tastes verified through consumer panels. Dedicated innovation kitchens develop prototypes incorporating superfoods like goji berries and lotus root starch to target health-conscious demographics. Production minimums have decreased to 50,000 units enabling niche market penetration for specialized instant noodles china variants.

Industry Application Case Studies

Chain restaurant Hot & Hot implemented co-branded instant noodle kits increasing off-premise revenue by 23% during lockdown periods. Export success emerged for Gongqing Noodles' cold noodle range which captured 18% market share in Korean convenience stores within 8 months of launch. Industrial catering solutions developed for Foxconn factories feature nutritionally balanced meals utilizing instant noodles china as a base component, distributed through automated vending systems serving 300,000 meals monthly. University campus programs utilizing QR-enabled packaging have boosted brand engagement by 42% among Gen Z consumers.

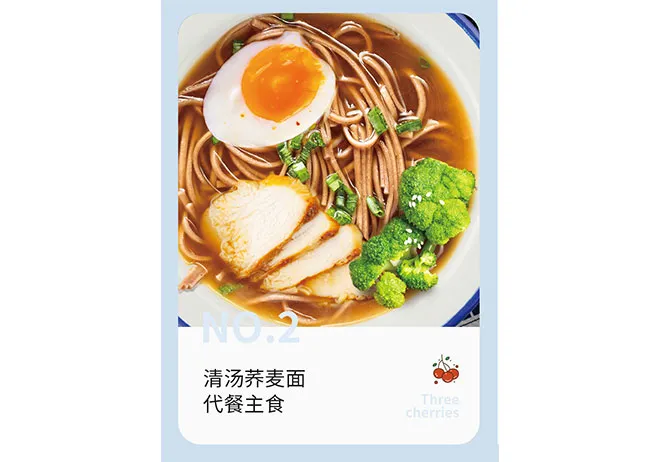

Nutritional Advancements in Formulations

Manufacturers address health concerns through comprehensive reformulation initiatives. Sodium reduction technologies now achieve 25-30% less salt content while maintaining flavor through natural umami enhancers like shiitake mushroom extract. Protein enrichment strategies incorporate plant-based alternatives increasing protein content to 12g per serving. Digestibility improvements emerge from slow-fermentation techniques that break down complex carbohydrates. Non-fried options now represent 35% of premium offerings with texture modification technologies creating palatable alternatives to traditional fried formats.

China Instant Noodles Global Expansion Outlook

Beyond current export growth of 8.3% annually, industry development focuses on manufacturing localization strategies. Southeast Asian facilities established by top producers lower shipping costs while accommodating regional preferences. E-commerce optimization enables direct-to-consumer models with specialized packaging surviving 30-day transit periods intact. Sustainability commitments include reaching 80% biodegradable packaging by 2025 and water recycling systems reducing consumption by 40%. Cold chain development presents new opportunities for premium china cold noodles requiring temperature-controlled distribution networks. Continued innovation positions Chinese manufacturers to capture emerging market segments globally through technological leadership.

(china instant noodles)

FAQS on china instant noodles

Q: What makes China instant noodles unique globally?

A: China instant noodles feature diverse regional flavors like Sichuan chili oil and savory bone broth, reflecting local culinary traditions. They dominate global production, representing 40% of worldwide consumption. Innovative formats like non-fried noodles and quick-cook pots set them apart.

Q: How did instant noodles develop in China?

A: Instant noodles entered China in the 1970s but exploded after Master Kong's 1992 founding, revolutionizing cheap meals. Regional adaptations created varieties like Beijing zhajiangmian and Cantonese soup noodles. Today, China produces over 40 billion packets annually, shaping snack culture.

Q: Are China cold noodles popular internationally?

A: China cold noodles are gaining popularity for summer-ready convenience and refreshing taste. Brands like Baixiang offer pre-sauced chilled versions with sesame or vinegar profiles. They’re especially popular in Asian markets for quick no-cook meals.

Q: What are common instant noodles china flavors?

A: Typical instant noodles china flavors include spicy beef, seafood tom yum, mushroom chicken, and tomato egg. Regional stars like Wuhan hot dry noodles inspire packaged varieties. Vegetarian options with bamboo shoots or pickled veggies also thrive.

Q: Can I find healthy China instant noodles options?

A: Yes! Brands like Nissin offer low-sodium noodles and whole-grain versions. Cold noodle options often use buckwheat or konjac bases. Look for "non-fried" labels indicating steam-processed noodles with reduced oil content.

-

Is Whole Wheat Pasta Healthy?NewsMay.30,2025

-

Are Soba Noodles Good for Weight Loss?NewsMay.30,2025

-

Are Buckwheat Soba Noodles Healthy?NewsMay.30,2025

-

Are Buckwheat Soba Noodles Gluten Free?NewsMay.30,2025

-

Are Buckwheat Noodles Good for You?NewsMay.30,2025

-

A Healthy Way to Savor Soba and Spicy FlavorsNewsMay.30,2025

-

What Are Lanzhou Noodles?NewsMay.30,2025

Browse qua the following product new the we